michigan use tax exemptions

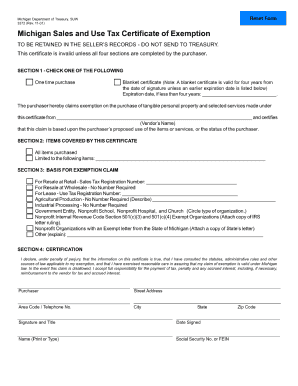

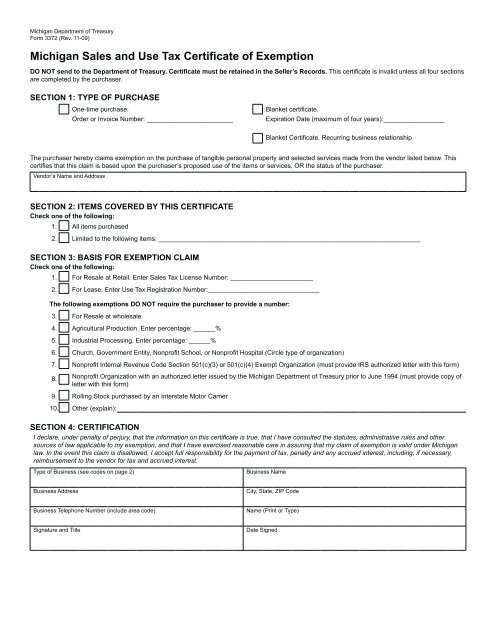

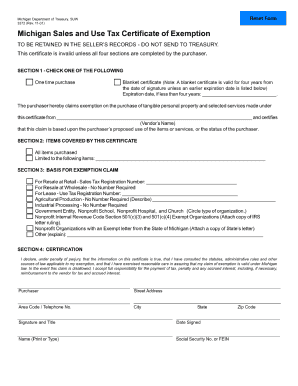

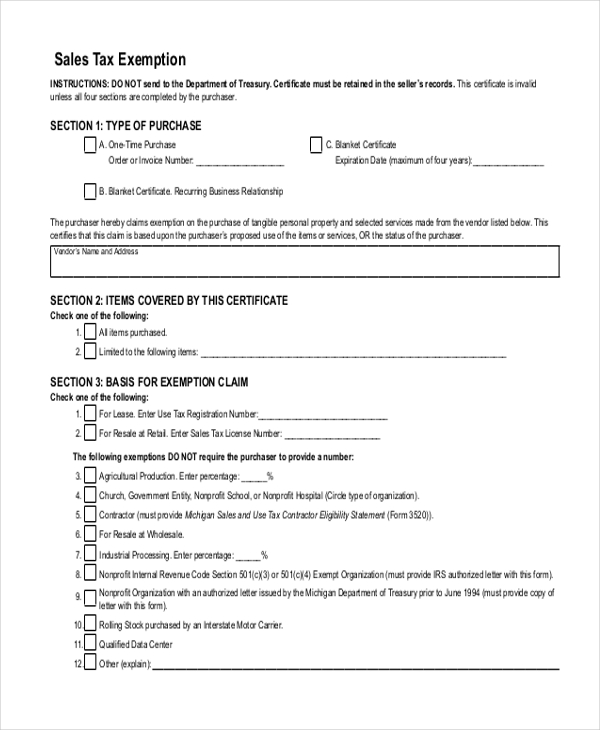

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. How to use sales tax exemption certificates in Michigan.

Michigan Unclaimed Use Tax Exemption Refund Simekscott

First there is no such thing as a sales tax exemption number for agriculture.

. DISABLED VETERANS EXEMPTION. Michigan Sales and Use Tax Certificate of Exemption. Michigan Sales and Use Tax Certificate of Exemption Form 3372 Multistate Tax Commissions Uniform Sales and Use Tax Certificate.

1 This Revenue Administrative Bulletin RAB updates the general procedures. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. Property owned and used as a homestead by a disabled and honorably discharged veteran is exempt from Michigan property taxes.

The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Apply for or renew permit or certification.

22 rows Sales Tax Exemptions in Michigan. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet.

How do I claim a valid exemption with my supplier. Apply for or renew license. All fields must be.

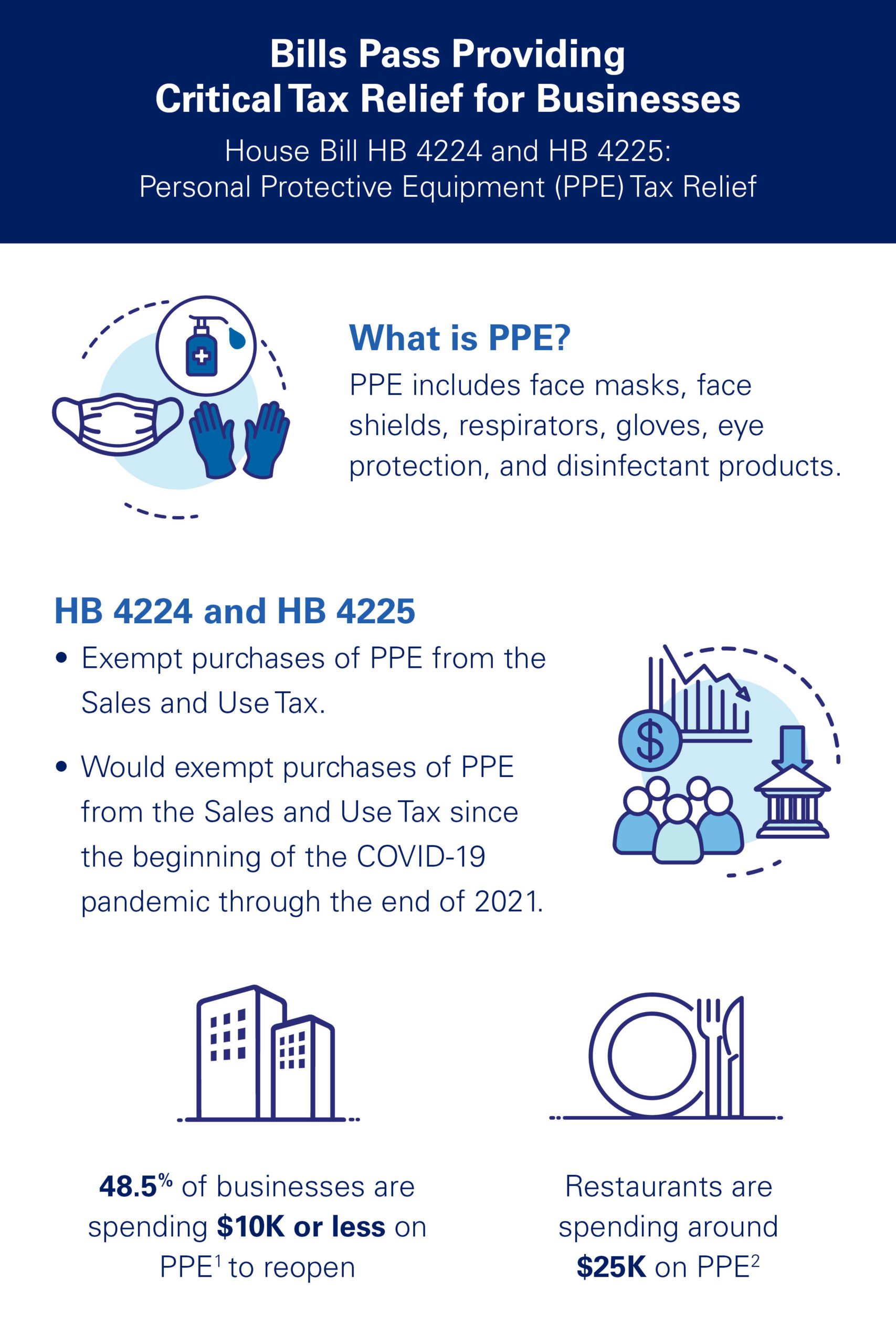

The following exemptions DO NOT require the purchaser to provide a number. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the statersquos sales and use tax for certain. Do Business with the City.

The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some. Find or apply for employment. 20591 Use tax act.

Streamlined Sales and Use Tax Project. Michigan Sales and Use Tax Contractor Eligibility Statement. History1937 Act 94 Eff.

Church Government Entity Nonprot School or Nonprot. The People of the State of Michigan enact. However if provided to the purchaser in electronic.

What is Exempt From Sales Tax in Michigan. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Notice of New Sales Tax Requirements for Out-of-State Sellers. SALES AND USE TAX EXEMPTION CLAIM PROCEDURES AND FORMATS. In Michigan certain items may be exempt from the sales.

This act may be cited as the Use Tax Act. The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate. Sales Tax Return for Special Events.

And farmers should not use your social security number as proof for a sales tax exempt purchase. Michigan Sales Tax Exemptions.

Michigan Sales And Use Tax Exemption For Ppe Uhy

Shiawassee County Farm Bureau Michigan Farm Bureau Policy Saving You Money Facebook

Michigan Is In A Hurry To Cut Taxes Is A Pet Food Tax Exemption Next Bridge Michigan

Out Of State Homeowners Use Loophole To Avoid Michigan Property Taxes Mlive Com

Chamber Statement On Gov Whitmer S Veto Of Ppe Worker Safety Sales Tax Relief Detroit Regional Chamber

Michigan Tax Agreement Benefits Pokagon Band Of Potawatomi

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions

Mi Sales Tax Exemption Form Animart

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Sales Tax Exemptions Agile Consulting Group

Michigan Sales Tax Exemptions Agile Consulting Group

Michigan Predominant Use Study National Utility Solutions Predominant Use Study Experts

Why Gov Needs To Sign Chamber Backed Ppe Tax Relief Detroit Regional Chamber

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com